Understanding New Jersey Medicaid Basics (And Why You Might Already Qualify)

Let's clear up some confusion about Medicaid eligibility in New Jersey. Many residents are surprised to learn they might actually qualify. NJ FamilyCare, New Jersey's Medicaid expansion program, has broadened access to healthcare for nearly 2 million residents. There are multiple pathways to coverage, from established family categories to the expanded program for adults.

This expanded coverage is something many people aren't aware of, meaning eligibility could be within reach for more people than they realize.

Who Qualifies for Medicaid in NJ?

Several factors determine Medicaid eligibility, including residency, citizenship, and income. However, common misconceptions often prevent eligible individuals from applying. This section aims to dispel those myths and explain New Jersey’s comparatively accessible eligibility framework. You may find this resource helpful: How to master Medicaid eligibility.

Income and the Federal Poverty Level

To qualify for Medicaid in New Jersey, you must meet specific criteria. As of August 2024, approximately 1,937,011 individuals were enrolled in NJ Medicaid, representing roughly 18% of the state's population. Eligibility often hinges on income relative to the federal poverty level (FPL). The Medicaid expansion covers adults with incomes up to 138% of the FPL. For example, the projected FPL for 2025 is $26,650 for a family of three and $15,650 for an individual. Find more detailed statistics here.

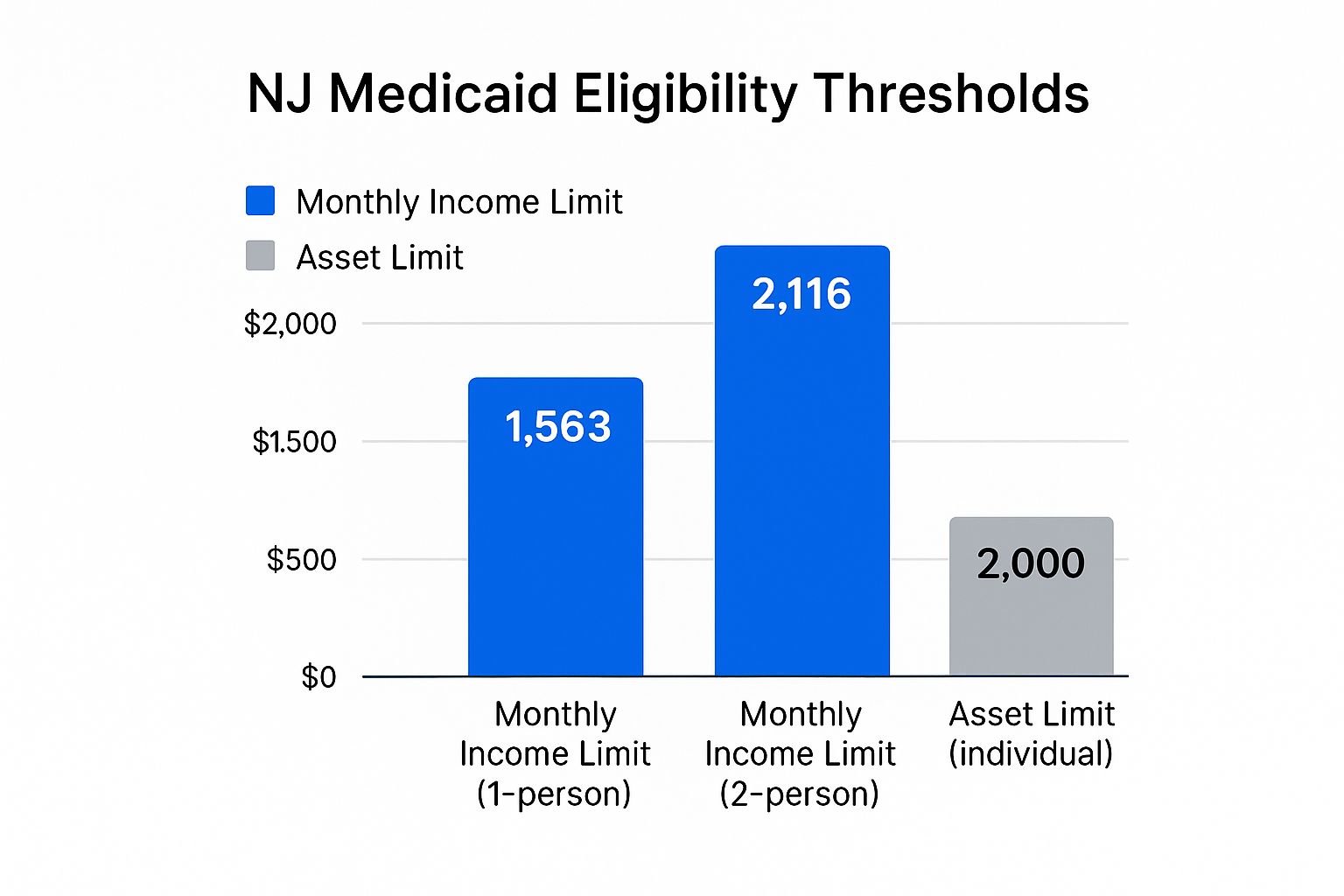

The following infographic highlights some key data points about NJ Medicaid eligibility, including monthly income limits for individuals and two-person households, along with individual asset limits.

As the infographic illustrates, income limits are often higher than many people assume, potentially making a significant portion of New Jersey residents eligible for coverage. The relatively low asset limit emphasizes that Medicaid primarily considers income when determining eligibility.

To further understand how income limits translate to different household sizes, let's take a closer look at the current guidelines.

The table below provides a detailed breakdown of the income thresholds based on household size and the 138% FPL.

New Jersey Medicaid Income Limits by Household Size

Current income thresholds for Medicaid eligibility based on federal poverty level percentages

| Household Size | 138% FPL Monthly Income | Annual Income Limit | Eligibility Category |

|---|---|---|---|

| 1 | $1,821 | $21,852 | Adult |

| 2 | $2,465 | $29,580 | Family |

| 3 | $3,109 | $37,308 | Family |

| 4 | $3,753 | $45,036 | Family |

| 5 | $4,397 | $52,764 | Family |

| This table represents estimated figures for illustrative purposes and may not reflect precise current values. Consult official resources for the most up-to-date information. |

This table clearly demonstrates how the income limits scale with household size. This tiered approach ensures that families of varying sizes have an opportunity to access necessary healthcare coverage. Understanding these guidelines is the first step in determining whether you might qualify for Medicaid assistance.

Income Rules That Actually Make Sense (Plus What Counts And What Doesn't)

Understanding New Jersey's Medicaid income rules is essential for determining your eligibility. While the process might seem complicated, it's built around a key concept: Modified Adjusted Gross Income (MAGI). This isn't just your gross pay; it's a specific calculation that includes some income sources while excluding others.

Decoding MAGI for New Jersey Medicaid

Your take-home pay isn't the deciding factor for Medicaid. New Jersey uses a unique formula to determine your MAGI. Let's explore what does and doesn't count towards this figure.

Income That Counts Towards MAGI:

- Wages and Salaries: Your earnings from a job are part of the MAGI calculation. It's important to note that it's not your total gross pay, but your adjusted gross income after specific deductions.

- Unemployment Benefits: While unemployment benefits provide temporary financial assistance, they are considered income for Medicaid eligibility.

- Social Security Benefits: Many types of Social Security benefits, such as retirement, disability, and survivor benefits, are typically included in your MAGI.

- Self-Employment Income: Earnings from freelancing, consulting, or other self-employment activities are factored into your MAGI. The good news is that you can deduct business expenses, potentially lowering your overall MAGI.

- Investment Income: Interest earned on bank accounts and dividends from investments like stocks and bonds contribute to your MAGI.

Income That Doesn't Count Towards MAGI

Several income sources are excluded from the MAGI calculation, providing some flexibility in eligibility:

- Child Support Received: Child support payments are not included, which is a crucial protection for single parents.

- TANF Benefits: Temporary Assistance for Needy Families (TANF) benefits are also excluded, helping families receiving this aid access healthcare.

Asset Limits: Less Restrictive Than You Think

New Jersey Medicaid considers both income and assets when determining eligibility. However, the asset limits are often less restrictive than people expect. For many applicants, asset levels won't be a barrier to receiving benefits.

Income Deductions: Lowering Your MAGI

You can lower your MAGI with certain deductions, possibly bringing it below the eligibility threshold. Deductible expenses can include eligible work-related costs, childcare expenses, and health insurance premiums.

Real-World Examples: Making Sense of the Rules

Consider a single adult with a $20,000 annual income. After deductions for work expenses and health insurance premiums, their MAGI could be significantly lower, potentially qualifying them for Medicaid. This underscores the importance of understanding not only what counts as income but also how deductions affect your final MAGI. Even if your initial income seems too high, exploring deductions might be key to accessing healthcare coverage.

Navigating The NJ FamilyCare Application Like A Pro

So, you're ready to apply for NJ FamilyCare. This section is your guide to a smooth and successful application. We'll explore different application methods, common issues, and how to ensure your application is processed quickly.

Choosing The Right Application Method

There are three main ways to apply for NJ FamilyCare: online, by phone, or in person. Each has its own advantages and disadvantages, which can affect processing times.

-

Online via GetCoveredNJ: This is generally the fastest and most convenient option. You can apply anytime, from anywhere, and upload necessary documents digitally.

-

By Phone: Applying by phone is good if you need help or prefer speaking to someone directly. Be aware that wait times can sometimes be longer than online applications.

-

In Person: You can apply in person at designated locations across New Jersey. This offers personalized assistance but requires scheduling an appointment and traveling.

Choosing the right method for your needs and resources can streamline the application process.

Avoiding Common Application Mistakes

Almost 40% of applications are delayed by avoidable mistakes. These often include incomplete information, missing documents, or inaccurate income details. Double-checking everything before submitting can save time and prevent frustration. For more helpful tips, see How to master the Medicaid application process.

Understanding The Review Process

Once submitted, your application undergoes a thorough review. Eligibility workers verify your information, check documents, and determine your eligibility based on factors like household size and income.

As of February 2025, the impact of potential Congressional budget proposals on Medicaid eligibility and benefits was being assessed in New Jersey. These proposals could affect provider pay and eligibility for the approximately 1.8 million New Jersey residents covered by NJ FamilyCare. Learn more about the potential impact of these budget proposals.

Tracking Your Application and Next Steps

After applying, keep track of your application status. Understanding the different stages—from “submitted” to “pending” to “approved”—can reduce uncertainty. It's also important to know who to contact if you haven't heard back within a reasonable timeframe. Being proactive can significantly impact how quickly your application is approved.

Document Gathering Made Simple (Even When Your Paperwork Is A Mess)

Applying for Medicaid in New Jersey requires specific documentation. Gathering these materials can sometimes feel overwhelming, especially if your personal paperwork isn't well-organized. This is a common experience for many applicants. This section provides practical advice, drawn from others who have successfully navigated the process, to help simplify document gathering. We'll cover the essential documents, acceptable alternatives, and strategies for addressing specific challenges.

Essential vs. Nice-to-Have Documents

The first step is to understand the difference between essential documents and nice-to-have documents. Essential documents are mandatory. Without them, your application will be considered incomplete. Nice-to-have documents can strengthen your application, but they aren't strictly required. This distinction helps you prioritize your efforts.

For instance, your Social Security card is an essential document. A recent utility bill, while helpful in confirming your residency, might be substituted with another form of proof of address. Focusing on the essentials first ensures you have the foundation of your application in place.

Handling Income Verification for Multiple Jobs and Irregular Pay

Income verification can be tricky, especially if you have multiple jobs, irregular pay, or if you've recently changed employment. A strategic approach is essential. Gather pay stubs for all jobs held within the required period.

If you have irregular income, such as from freelance work, bank statements showing consistent deposits can serve as income verification. For recent job changes, provide documentation from both your previous and current employer to give a complete picture of your income history.

Tackling Tricky Situations: Missing Documents and Expired IDs

It's possible you might be missing a key document, like a birth certificate, or your ID might be expired. Don't panic. There are often acceptable alternatives.

If you are missing a birth certificate, a hospital-issued birth record or a baptismal certificate might suffice. If your ID is expired, contact the issuing agency for a replacement and explain your situation to the Medicaid office. They may offer temporary solutions while you await your new ID. Similar strategies can apply to situations involving immigration documents as well.

Before we move on, take a look at the table below to see the full range of documents you may need:

Introducing the "Essential Documents Checklist for NJ Medicaid Application" table. This comparison table provides a complete list of required and acceptable documents, categorized for easy reference. It will serve as a quick guide as you gather your materials.

| Document Category | Required Documents | Acceptable Alternatives | Notes |

|---|---|---|---|

| Identity | Driver's License, State ID | Passport, Military ID | Must be current and valid or explain expiration to the Medicaid office |

| Social Security Number | Social Security Card | Official Social Security Administration document stating your number | Required for all applicants |

| Residency | Utility bill, Lease agreement | Bank statement, Letter from a shelter | Proof of current address in New Jersey |

| Income | Pay stubs, Employer letter | Tax returns, Bank statements | Verification of all income sources within the required period |

| Citizenship/Immigration Status (if applicable) | Green Card, US Passport | Other USCIS documents | Consult with the Medicaid office for specific requirements |

| Birth Certificate | Original Birth Certificate | Hospital-issued birth record, Baptismal certificate | Required for age verification |

This table clarifies the essential documents needed for a New Jersey Medicaid application and suggests potential alternatives if you're missing the originals. Having these alternatives in mind can save valuable time and reduce stress during the application process.

Expediting Document Requests and Responding to Additional Verification

Requesting documents from government agencies can take time. However, you can often expedite the process. Call the agency directly, explain the urgency of your request, and provide all necessary identifying information. This proactive approach can significantly shorten the waiting time.

Sometimes, the Medicaid office will request additional verification. Respond to these requests promptly. A quick response keeps your application moving and demonstrates your commitment to completing the process. This ensures a faster and more efficient path toward potentially securing Medicaid coverage.

Special Situations And Hidden Pathways To Coverage

New Jersey Medicaid offers specialized routes to coverage, acknowledging that not everyone fits standard eligibility criteria. These less-known pathways can be essential for individuals and families in unique circumstances. Even if you initially don't qualify based on general guidelines, you might still be eligible.

Expanding Coverage For Pregnant Women And New Mothers

Expectant mothers in New Jersey benefit from expanded Medicaid access. Income limits are higher for pregnant women, reaching 200% of the Federal Poverty Level (FPL). This recognizes the financial strain of pregnancy and childbirth, ensuring access to vital prenatal and postnatal care. Importantly, postpartum coverage extends beyond the immediate delivery period, offering continued support for new mothers.

Pathways For People With Disabilities

Medicaid eligibility for people with disabilities goes beyond traditional definitions in New Jersey. The state recognizes a broader scope of conditions and functional limitations, helping ensure access to necessary healthcare services. This broader perspective allows individuals to manage their conditions and maintain their overall well-being. For those seeking more information on home healthcare and Medicaid, this resource might be helpful: How to master home health care Medicaid.

Coverage Options For Former Foster Youth

Young adults aging out of foster care have extended Medicaid coverage options in New Jersey. This vital safety net offers continued healthcare access during their transition to independence, providing stability and support through adulthood.

Emergency Medicaid, Native Americans, And Transitional Coverage

New Jersey Medicaid addresses immediate healthcare needs through provisions for emergency medical situations, irrespective of traditional eligibility. Specific rules also apply to Native Americans, acknowledging their unique circumstances. Additionally, transitional coverage helps bridge gaps in healthcare access when individuals lose other insurance, providing continuous support during these changes.

Understanding The Broader Context of Medicaid

Medicaid in New Jersey, like in many states, is complex. The state's Medicaid and CHIP programs are part of a larger national network. As of January 2025, over 71 million people were enrolled in Medicaid nationwide. Explore this topic further. In New Jersey, Medicaid covers essential healthcare services for diverse populations, including children, adults, and those with disabilities. It plays a significant role, covering 30% of births in the state.

Presumptive Eligibility And Life Changes

Presumptive eligibility provides immediate Medicaid access while your full application is being processed. This is especially helpful during urgent health situations. Life changes, such as divorce, job loss, or aging out of a parent's insurance, can also open new pathways to Medicaid qualification. These situations often bring shifts in income and healthcare access, highlighting the importance of these specialized pathways.

What Happens Next (And How To Secure Your Coverage Long-Term)

After submitting your New Jersey Medicaid application, it's important to understand the next steps and how to maintain your coverage. This knowledge will help you navigate the process and ensure continued access to healthcare.

From Application to Approval: Understanding the Timeline

The time between application submission and approval varies. Several factors influence this, including the completeness of your application and the current application volume. While you wait, monitor your application status and understand what the different updates mean. Common statuses might include "submitted," "processing," "pending verification," or "approved."

Preparing for Potential Interviews and Requests for Information

The Medicaid office may request additional information or schedule an interview to clarify details on your application. Being prepared for these possibilities can prevent delays. Organize your documents, review your application, and be ready to answer questions about your income, household size, and other relevant details. This preparation can streamline the process and potentially speed up approval.

Approval Day: What to Expect and Accessing Your Benefits

Once approved, you’ll receive a notification, usually by mail or electronically. This notification will confirm your coverage start date and explain how to access your benefits. Understand your coverage details, including covered services and how to find participating healthcare providers. Contact the Medicaid office directly if you have any questions.

Maintaining Your Coverage: Annual Renewals and Reporting Life Changes

Medicaid coverage typically requires annual renewal. Understanding this process and promptly reporting life changes is crucial for uninterrupted coverage. Changes that could affect your eligibility include changes in income, household size, or disability status. Accurate and timely reporting is vital for continued access to healthcare services. NJ Caregiving can assist you in managing these details and provide comprehensive support.

Know Your Rights and How to Appeal Decisions

Understand your rights as a Medicaid beneficiary. If you disagree with a decision about your application or coverage, you have the right to appeal. The appeal process lets you present your case and potentially overturn the initial decision. Knowing how to navigate this process empowers you to advocate for your healthcare needs.

Resources for Assistance: Getting the Help You Need

Navigating Medicaid can be challenging. Fortunately, resources are available to help you. Organizations like NJ Caregiving offer support with applications, renewals, and understanding your rights. These resources provide valuable assistance and guidance.

For compassionate in-home care for seniors and individuals with disabilities in Mercer County, New Jersey, contact NJ Caregiving. We offer a wide range of services tailored to your needs. Our team is dedicated to enhancing independence, comfort, and quality of life.